Tariffs Explained: The Economics Behind the Trade Practice

Tariffs have been a contentious issue in international trade for centuries, with each country seeking to protect its economic interests while navigating the complexities of global commerce. In today's interconnected world, tariffs play a significant role in shaping the trade landscape, with far-reaching consequences for economies, industries, and consumers alike. In this article, we will delve into the economics behind tariffs, exploring their history, types, impacts, and implications for global trade.

The concept of tariffs dates back to the 17th century, when European countries imposed taxes on imported goods to protect their domestic industries. Over time, tariffs evolved to become a cornerstone of international trade policy, with countries using them to regulate the flow of goods and services across borders. While tariffs were initially intended to promote domestic economic growth, their use has become increasingly controversial, with many arguing that they distort trade flows and raise prices for consumers.

At its core, a tariff is a tax imposed on imported goods or services. The revenue generated from tariffs is typically used to finance government programs, infrastructure development, or other public expenditures. There are two primary types of tariffs: ad valorem and specific. Ad valorem tariffs are calculated as a percentage of the goods' value, while specific tariffs are fixed amounts levied on specific goods or industries.

History of Tariffs

The history of tariffs is complex and varied, reflecting the changing economic and political landscapes of different countries and regions. In the United States, for example, tariffs were first introduced in the late 18th century to protect American industries from foreign competition. The Tariff Act of 1828, also known as the Tariff of Abominations, was one of the most significant tariffs in American history, imposing duties on imported goods such as cotton and sugar.

In Europe, tariffs played a crucial role in the development of the Industrial Revolution. Countries such as Britain and France used tariffs to protect their domestic industries, which were critical to their economic growth and competitiveness. However, as global trade expanded, tariffs became increasingly contentious, with countries seeking to reduce or eliminate them to promote free trade and economic integration.

Types of Tariffs

There are several types of tariffs, each with its own characteristics and implications for trade. The following are some of the most common types of tariffs:

- Ad Valorem Tariffs: These tariffs are calculated as a percentage of the goods' value. For example, a tariff of 20% on imported goods means that the duty is 20% of the goods' value.

- Specific Tariffs: These tariffs are fixed amounts levied on specific goods or industries. For example, a tariff of $10 per ton on imported steel means that the duty is $10 per ton of steel.

- Agricultural Tariffs: These tariffs are imposed on agricultural products to protect domestic farmers and promote domestic production.

- Industrial Tariffs: These tariffs are imposed on industrial products to protect domestic industries and promote domestic production.

- Infant Industry Tariffs: These tariffs are imposed on new industries to protect them from competition and allow them to mature.

- Counter-Vailing Duties (CVDs): These tariffs are imposed on imported goods to offset the effects of subsidies or other forms of government support.

Impacts of Tariffs

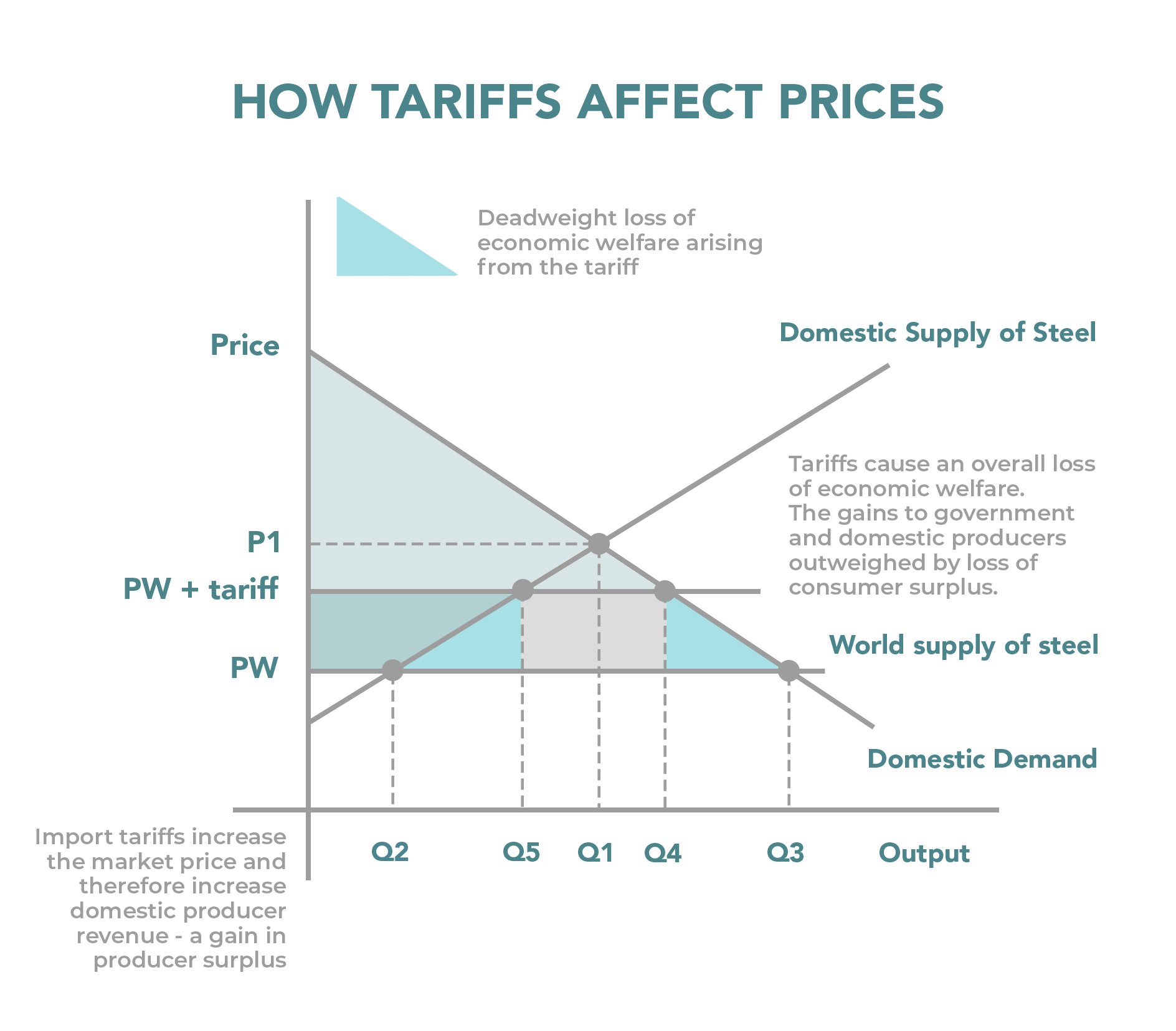

Tariffs have far-reaching impacts on trade, economies, and consumers. Some of the key effects of tariffs include:

- Higher Prices: Tariffs raise prices for consumers, as they increase the cost of imported goods and services.

- Reduced Trade: Tariffs reduce trade between countries, as they increase the cost of imports and make it less competitive for domestic producers to export goods.

- Distorted Trade Flows: Tariffs distort trade flows, as they create barriers to entry and limit the competition between domestic and foreign producers.

- Inefficient Allocation of Resources: Tariffs can lead to inefficient allocation of resources, as they create distortions in the market and allocate resources to inefficient producers.

International Trade Agreements

To mitigate the negative effects of tariffs, countries have entered into a range of international trade agreements. Some of the most significant agreements include:

- General Agreement on Tariffs and Trade (GATT): This agreement, signed in 1947, established a set of rules for international trade and reduced tariffs on many goods.

- North American Free Trade Agreement (NAFTA): This agreement, signed in 1994, created a free trade area between the United States, Canada, and Mexico.

- World Trade Organization (WTO): This organization, established in 1995, promotes free trade and provides a framework for countries to negotiate trade agreements.

- Trans-Pacific Partnership (TPP): This agreement, signed in 2016, created a free trade area between 12 countries in the Asia-Pacific region.

Conclusion

Tariffs are a complex and contentious issue in international trade, with both positive and negative effects on trade, economies, and consumers. While tariffs can protect domestic industries and promote economic growth, they also create barriers to entry and limit the competition between domestic and foreign producers. To promote free trade and economic integration, countries must navigate the complexities of tariffs and find solutions that balance the interests of different stakeholders.

Seopetition Tracker

Who Ihad Kroeger Married To

Morgan Vera

Article Recommendations

- Nsfw Twitter

- Hisashi Ouchi Real Hospital Po

- Karlanenio Crime Pos

- Is Justin Bieberied

- Matthew Labyorteaux

- Jameliz Benitez

- King Von Autospy

- Matthew Gray Gubler

- Neil Flynn

- Carly Jane Fans

:max_bytes(150000):strip_icc()/Tariff-4188187-final-070716a9bd23499d861283857dad0cf0.png)