Tech Selloff Sparks Oversold QQQ, Could This ETF Be A Buy?

The technology sector has been a leading driver of the US stock market for years, and investors have been eagerly following its every move. However, in recent weeks, the sector has been hit by a series of negative events, sparking a significant sell-off in tech stocks. This has led to a major correction in the broader market, and investors are now wondering if the oversold condition of the Nasdaq-100 ETF (QQQ) could be an opportunity to buy.

The QQQ is one of the most widely followed tech ETFs, tracking the performance of the top 100 non-financial stocks listed on the Nasdaq composite index. These stocks are often considered to be the tip of the tech iceberg, representing some of the most innovative and growth-driven companies in the industry. As such, the QQQ is a key barometer of the tech sector's health, and its oversold condition could be a buy signal for savvy investors.

In this article, we'll take a closer look at the current market situation, the reasons behind the tech sell-off, and what it might mean for the QQQ. We'll also examine the potential buying opportunities that exist in the current oversold condition of the ETF.

The Current Market Situation

The current market situation is characterized by a perfect storm of negative events that have contributed to the tech sell-off. One of the main factors is the ongoing trade tensions between the US and China, which have raised concerns about the growth prospects of tech companies that rely heavily on Chinese suppliers. Additionally, the COVID-19 pandemic has led to widespread lockdowns and supply chain disruptions, further exacerbating the sell-off.

Another factor that has contributed to the tech sell-off is the significant decline in the prices of major tech stocks such as Apple, Amazon, and Alphabet. These companies are often considered to be the backbone of the tech sector, and their decline has led to a wave of selling in the broader market.

Despite these negative events, the tech sector has also been subject to a series of positive events that could help to alleviate some of the concerns about its growth prospects. For example, the rapid growth of cloud computing and the increasing adoption of remote work arrangements have created new opportunities for tech companies.

The Reasons Behind the Tech Sell-Off

So what are the specific reasons behind the tech sell-off? Here are some of the key factors that have contributed to the decline:

- Trade tensions with China: The ongoing trade tensions between the US and China have raised concerns about the growth prospects of tech companies that rely heavily on Chinese suppliers.

- COVID-19 pandemic: The COVID-19 pandemic has led to widespread lockdowns and supply chain disruptions, further exacerbating the sell-off.

- Decline in major tech stocks: The significant decline in the prices of major tech stocks such as Apple, Amazon, and Alphabet has led to a wave of selling in the broader market.

- Valuation concerns: Some investors have expressed concerns about the high valuation of the tech sector, which could make it vulnerable to a correction.

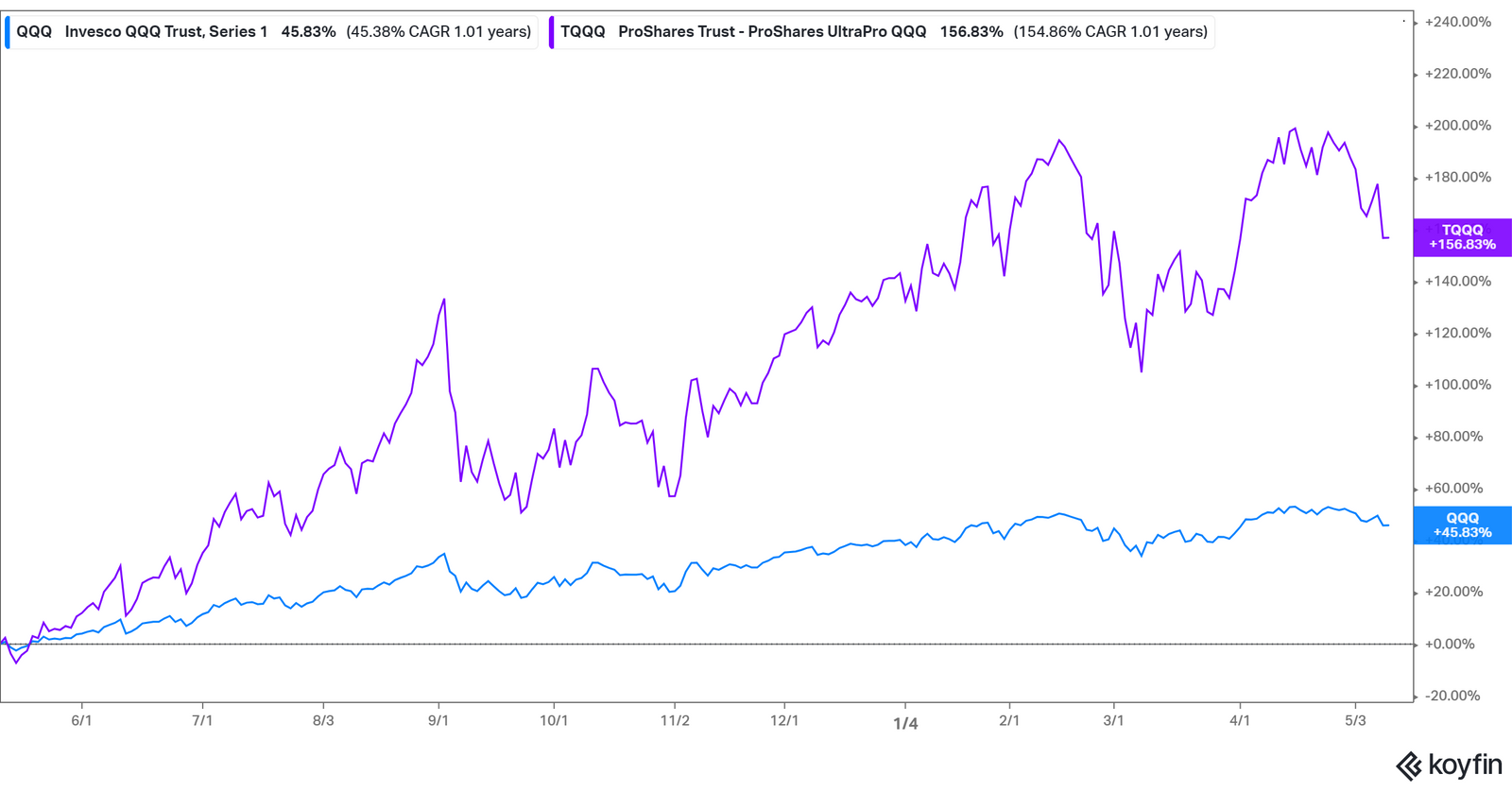

The Oversold Condition of the QQQ

So what does the current market situation mean for the QQQ? Here are some key points to consider:

- Oversold condition: The QQQ is currently oversold, meaning that its price has fallen significantly below its moving averages.

- Low trading volume: The QQQ has experienced low trading volume in recent weeks, which could indicate a lack of confidence among investors.

- Potential buying opportunity: The oversold condition of the QQQ could provide a buying opportunity for investors who are looking to get back into the tech sector.

Key Statistics

Here are some key statistics that illustrate the current situation:

- QQQ price: The current price of the QQQ is $264.44, down 15% from its 52-week high.

- Moving averages: The 50-day moving average of the QQQ is $271.44, while the 200-day moving average is $274.44.

- Trading volume: The trading volume of the QQQ has been low in recent weeks, averaging around 10 million shares per day.

Potential Buying Opportunities

So what opportunities might exist in the current oversold condition of the QQQ? Here are some potential buying opportunities to consider:

- Value investing: The QQQ is currently trading at a discount to its historical average, making it a potential value investment opportunity.

- Long-term investing: The QQQ has a strong track record of long-term performance, making it a potential long-term investment opportunity.

- Dividend investing: The QQQ includes several dividend-paying stocks, making it a potential dividend investment opportunity.

Dividend-paying Stocks

Here are some of the dividend-paying stocks that are included in the QQQ:

- Apple: Apple is one of the largest dividend-paying stocks in the QQQ, with a dividend yield of around 2%.

- Amazon: Amazon also pays a dividend, with a yield of around 1%.

- Alphabet: Alphabet pays a dividend, with a yield of around 2%.

Conclusion

In conclusion, the tech sell-off has created a significant buying opportunity for investors who are looking to get back into the sector. The oversold condition of the QQQ provides a potential buying opportunity for investors who are looking to buy into the tech sector at a discount. However, it's essential to keep in mind that the tech sector is highly volatile and subject to a range of risks, including trade tensions, pandemics, and valuation concerns. As such, investors should exercise caution and conduct their own research before making any investment decisions.

How Tall Isabrina Carpenter

Kimol Song

Did Karla Homolka Parents Forgive Her

Article Recommendations

- Piddy Passed Away

- Hisashi Ouchi Real Po

- Kay Flock

- Billieilish Y Pics

- Tate Mcrae

- Sophie Rain Fans

- Nora Bint Mohammad Binalman Alaud

- Ava Baronibs

- Aitana Bonmat Partner

- Sarah Vowell