Unlock High Dividend Gains: Is Vanguard Dividend Appreciation ETF The Smartest Bet?

As the financial landscape continues to evolve, investors are on the lookout for strategies that can help them generate consistent returns while minimizing risk. One effective approach is investing in dividend-paying stocks, which have historically provided a steady stream of income. In this article, we'll explore the benefits of investing in dividend-paying stocks and examine whether the Vanguard Dividend Appreciation ETF (VIG) is the smartest bet for achieving high dividend gains.

The Dividend King

Dividend-paying stocks have been a cornerstone of investing for centuries. These stocks offer a way for investors to earn a regular income stream, which can be particularly appealing in a low-interest-rate environment. By investing in dividend-paying stocks, investors can create a diversified portfolio that generates a steady flow of income, reducing their reliance on capital gains and interest payments.

Some of the most successful investors in history, including Warren Buffett and Charlie Munger, have built their wealth through dividend investing. These investors understand the power of compounding and the importance of consistent dividend payments in creating long-term wealth.

The Benefits of Dividend Investing

Investing in dividend-paying stocks offers a range of benefits, including:

• Regular income stream: Dividend-paying stocks provide a regular source of income, which can be particularly appealing in a low-interest-rate environment.

• Lower volatility: Dividend-paying stocks tend to be less volatile than growth stocks, reducing the risk of significant price fluctuations.

• Inflation protection: Dividend payments can help protect against inflation, as companies can increase their dividend payments to keep pace with rising costs.

• Diversification: Dividend-paying stocks can help diversify a portfolio, reducing reliance on a single asset class or industry.

Types of Dividend-Paying Stocks

While all dividend-paying stocks offer a regular income stream, some types are more attractive than others. These include:

• Large-cap stocks: Large-cap stocks, such as those in the S&P 500, tend to offer more stable dividend payments and lower volatility.

• Dividend aristocrats: Companies that have increased their dividend payments for 25 consecutive years are considered dividend aristocrats, offering a high level of consistency and stability.

• Real estate investment trusts (REITs): REITs offer a dividend-paying stock option for investors looking to invest in real estate without directly owning physical properties.

ETFs and Index Funds

One of the most effective ways to invest in dividend-paying stocks is through exchange-traded funds (ETFs) and index funds. These funds provide instant diversification and can be easily tracked, reducing the need for ongoing research and management.

Some popular ETFs and index funds for dividend investing include:

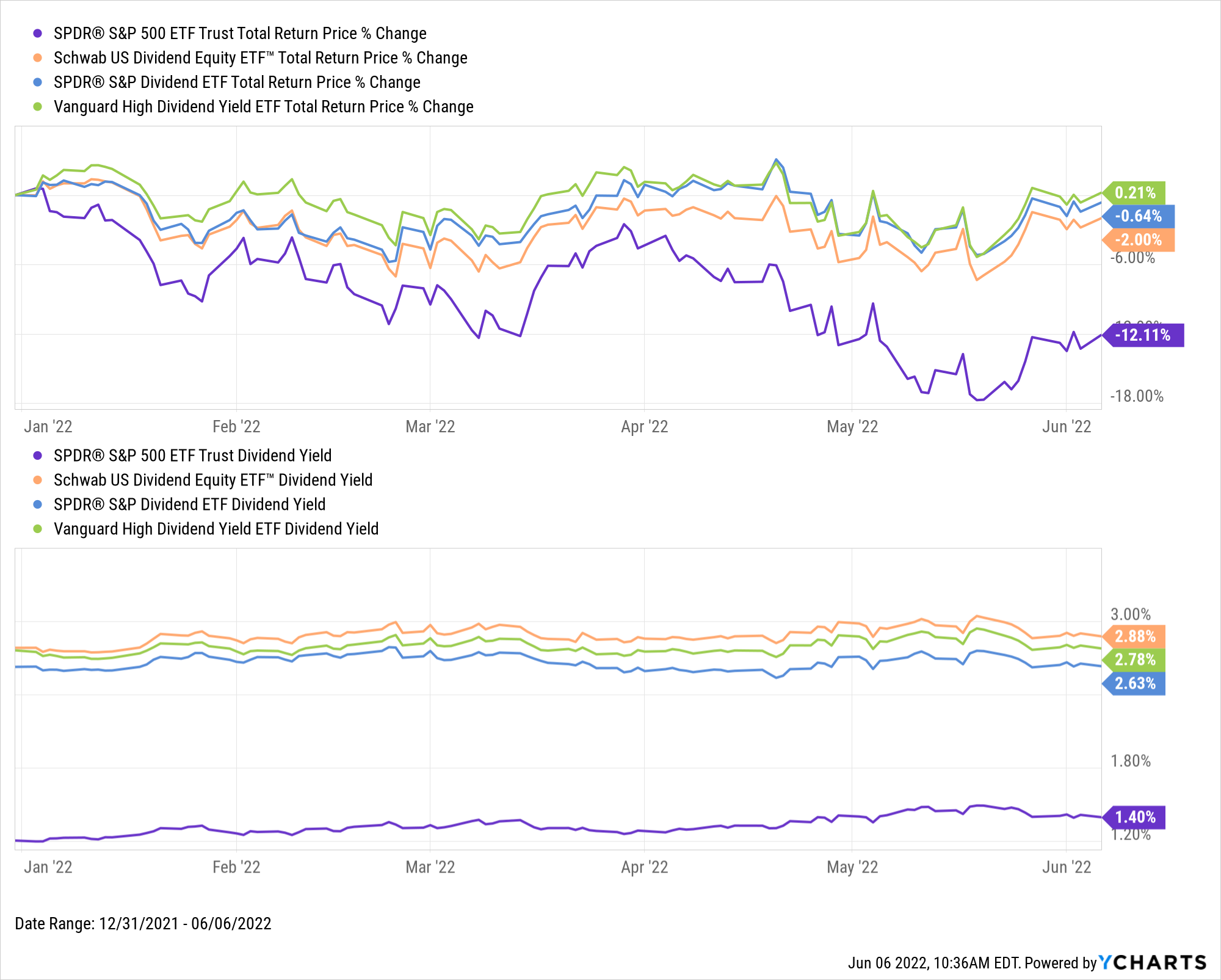

• Vanguard Dividend Appreciation ETF (VIG): VIG tracks the Nasdaq U.S. Dividend Achievers Index, offering exposure to 80 dividend-paying stocks with a history of increasing their dividend payments.

• iShares Core S&P U.S. Dividend Aristocrats ETF (NOBL): NOBL tracks the S&P U.S. Dividend Aristocrats Index, offering exposure to 60 dividend-paying stocks that have increased their dividend payments for 25 consecutive years.

• Schwab U.S. Dividend Equity ETF (SCHD): SCHD tracks the Dow Jones U.S. Dividend 100 Index, offering exposure to 100 dividend-paying stocks with a history of stable dividend payments.

The Vanguard Dividend Appreciation ETF (VIG)

The Vanguard Dividend Appreciation ETF (VIG) is one of the most popular and widely followed dividend ETFs. By tracking the Nasdaq U.S. Dividend Achievers Index, VIG offers exposure to 80 dividend-paying stocks with a history of increasing their dividend payments.

Some of the key benefits of investing in VIG include:

• High dividend yield: VIG offers a dividend yield of around 2.2%, making it an attractive option for income-seeking investors.

• Consistent dividend payments: VIG's dividend payments have increased for 27 consecutive years, demonstrating the fund's commitment to providing a stable income stream.

• Low fees: VIG charges a relatively low expense ratio of 0.05%, making it an attractive option for investors looking to minimize costs.

Portfolio Optimization

To get the most out of VIG, investors should consider the following portfolio optimization strategies:

• Diversification: Invest in a diversified portfolio of ETFs and index funds to minimize risk and maximize returns.

• Risk management: Regularly review and adjust the portfolio to ensure it remains aligned with investment goals and risk tolerance.

• Tax efficiency: Consider the tax implications of dividend payments and aim to minimize tax liabilities.

Conclusion

Investing in dividend-paying stocks and ETFs offers a powerful way to generate consistent returns and reduce risk. The Vanguard Dividend Appreciation ETF (VIG) is a popular and widely followed option, offering exposure to 80 dividend-paying stocks with a history of increasing their dividend payments. By considering the benefits of dividend investing, understanding the types of dividend-paying stocks, and optimizing the portfolio, investors can unlock high dividend gains and achieve their long-term investment goals.

Investors should always consult with a financial advisor or conduct their own research before making investment decisions.

Hisashi Ouchi

How Old Iarleyhimkus

Sabrina Carpenter Height Ft

Article Recommendations

- Rebecca Pritchard 2024

- How Tall Is Brad Pitt

- Girl Meets Farm Cancelled

- Brooke Monk

- Alina Habba Net Worth

- Nikki Catsourasate

- Timothy Olyphant

- Julianne Phillips

- Laura Ingraham Husband Po

- Kaitlan Collinsthnicity