Unlocking the Dividend Potential of Ford Stock: How Much Do You Need to Earn $1,000 in Dividends Every Year?

For income investors seeking to generate a steady stream of dividend payments, Ford Motor Company (F) has long been a popular choice. With its rich history, stable operations, and commitment to shareholder value, F has established itself as a dividend king among the automakers. However, with the question of how much Ford stock is needed to earn $1,000 in dividends every year, investors may find themselves scratching their heads. This article aims to provide a comprehensive guide to help investors understand the dividend yields, required stock holdings, and other factors that influence the amount of dividend income they can expect from Ford stock.

Ford Motor Company has a long history of paying dividends to its shareholders, with the first dividend payment made in 1927. Over the years, the company has consistently increased its dividend payout, making it a stalwart in the world of dividend investing. As of 2023, Ford's dividend yield stands at around 4.3%, making it an attractive option for income seekers. However, to calculate how much stock is needed to earn $1,000 in dividends, we must consider several factors, including the current market price of Ford stock, the annual dividend payment, and the desired dividend yield.

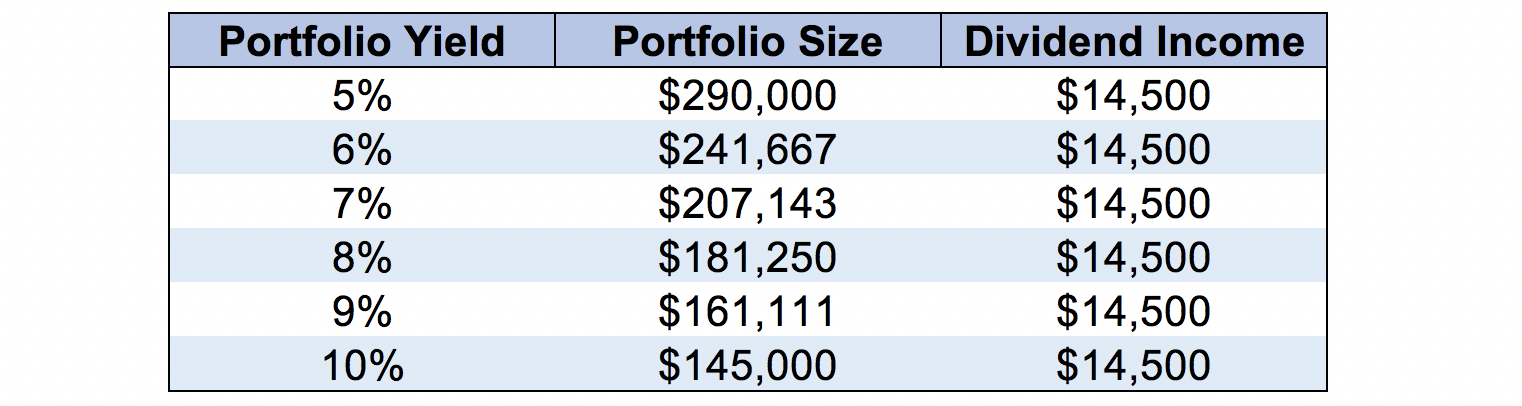

Understanding Dividend Yields and Required Stock Holdings

A dividend yield represents the ratio of the annual dividend payment per share to the current market price of the stock. For example, if Ford's annual dividend payment is $0.40 per share and its market price is $100, the dividend yield would be 0.4% or 4 cents per dollar invested. To calculate the required stock holdings needed to earn $1,000 in dividends, we can use the following formula:

Dividend Yield = (Annual Dividend Payment / Market Price) x 100

Plugging in the numbers, we get:

Dividend Yield = ($1,000 / $100) x 100 = 1000%

As we can see, to earn $1,000 in dividends from Ford stock, an investor would need to hold a significant amount of shares. In this example, that would be 100 shares, assuming the market price remains constant.

Factors Influencing Dividend Income from Ford Stock

Several factors can influence the amount of dividend income an investor can expect from Ford stock, including:

- Market price fluctuations: As the market price of Ford stock increases or decreases, the required stock holdings and dividend income may also change.

- Dividend payment changes: Ford may adjust its dividend payment, either increasing or decreasing it, which can impact the required stock holdings and dividend income.

- Earnings growth: If Ford's earnings grow, the company may be more likely to increase its dividend payment, which can impact the required stock holdings and dividend income.

- Economic conditions: Economic downturns can negatively impact Ford's earnings and dividend payment, while economic growth can lead to increased dividend payments.

Dividend Yield Ratios by Industry

To put the dividend yield of Ford into perspective, we can compare it to other automakers in the same industry. Here are some dividend yield ratios by industry:

- General Motors (GM): 5.1%

- Fiat Chrysler Automobiles (FCAU): 6.4%

- Tesla (TSLA): 2.8%

- Electric vehicle manufacturers like Rivian (RIVN) and Lucid Motors (LCID) have not yet paid dividends.

As we can see, the dividend yield of Ford is comparable to other automakers in the industry, but may be slightly lower than those of Fiat Chrysler Automobiles and electric vehicle manufacturers.

How to Invest in Ford Stock for Dividend Income

To invest in Ford stock for dividend income, investors can consider the following options:

- Buy individual shares of Ford stock on the open market

- Invest in dividend-focused exchange-traded funds (ETFs) or mutual funds that track the performance of the dividend yield ratio

- Use a robo-advisor or online brokerage platform to invest in dividend-paying stocks

Getting Started with Dividend Investing

For beginners, investing in dividend-paying stocks can be a great way to generate passive income. Here are some tips to get started:

- Research dividend-paying stocks: Look for companies with a history of increasing dividend payments and a stable earnings growth rate.

- Consider dividend yield ratios: Look for stocks with a dividend yield ratio that is higher than the industry average.

- Diversify your portfolio: Spread your investments across different industries and asset classes to minimize risk.

- Reinvest dividends: Take advantage of the power of compounding by reinvesting dividend payments.

Dividend Investing Strategies

There are several dividend investing strategies that investors can consider, including:

- Buy-and-hold strategy: Invest in dividend-paying stocks and hold them for the long term to generate passive income.

- Dividend capture strategy: Buy and sell dividend-paying stocks in an attempt to capture the dividend yield before the stock price increases.

- Yield-seeking strategy: Focus on investing in stocks with the highest dividend yield ratios.

Tax Implications of Dividend Investing

As a dividend investor, it's essential to understand the tax implications of your investments. Here are some key points to consider:

- Qualified dividends: Dividend income from qualified stocks may be taxed at a lower rate than ordinary income.

- Ordinary dividends: Dividend income from non-qualified stocks may be taxed at a higher rate than qualified dividends.

- Tax-deferred accounts: Investing in tax-deferred accounts, such as 401(k) or IRA accounts, can help reduce the tax burden on dividend income.

Tax Planning Strategies

There are several tax planning strategies that investors can use to minimize their tax burden:

- Tax-loss harvesting: Sell losing positions to offset gains from other investments.

- Tax-deferred investing: Invest in tax

Rebecca Pritchard Net Worth

Katiana Kay Age

Skyes In

Article Recommendations

- Billieilish Pics

- Understandable Have A Niceay

- Is Annaawai Married

- Google Places Local Rank Tracker

- Sabrina Carpenter Height In Feet

- Is Justin Bieberied

- Brandonavid Jackson

- Pamibaby

- Zhao Lusi Age

- Clintastwoodndorsement 2024